Shipping and CO2 - The Big Picture - Part 2

In Part 1 we saw that the shipping fleet has grown by about 58% in GT terms between 2007 and 2015, while CO2 emission per annum has reduced by about 11%. As a way of visualising the changes of CO2 and GT over time, we could use a composite measure - CO2/GT - ie the CO2 intensity per GT per annum which is a crude measure of fleet efficiency but accounts for both new ships and existing ships.

This measure has gone from 1.23 to 0.7, a reduction of 43%. But this could also mask some things like overcapacity, low utilisation, idle ships, port congestion - lots of tonnage lying around doing nothing. However, since we have both tonne miles data and CO2, we could derive a rough measure in g CO2/tonne miles which is somewhat similar to EEOI, but for the fleet as a whole, a sort of fleet average CO2 intensity if you like.

As of 2015, we are about 30% better off in gCO2 per tonne mile (21.6 to 15.2) than the peak year of 2008 for the fleet as a whole (new and existing ships), though not quite as rosy a picture as the CO2/GT version. The missing two years of data for 2005 and 2006 is purely because they were available for tonne miles, but not for GT.

How you interpret this probably depends on your perspective – if you look on a per ship level (as a shipowner trying to balance the books will), this is progress achieved in the absence of regulation; but if you look from a world fleet perspective and total CO2 emissions, the growth in the world fleet has nullified the effect of efficiency improvements.

From the perspective of 2005-2015, it looks like the world fleet has never been more efficient, but at the same time those efficiency improvements appear to be tailing off. It does seem also that the discrepancy between the CO2/GT and CO2 per tonne mile measures points to lower overall utilisation of the fleet. This begs the question:

Is it better (in terms of reducing CO2) to have low fleet utilisation and poor market conditions due to over capacity in the world fleet, or to encourage scrapping of older tonnage that is supposedly less efficient?

As mentioned in Part 1, we can't explicitly attribute any of this to the EEDI requirements as they apply only to newbuilds contracted from 2013 onwards (fleet replacement running around 3% per annum), which would only have been delivered from perhaps 2014 onwards or later, while the above charts are for the whole fleet.

So how has shipping achieved these improvements fleet wide? The usual explanation is widespread slow steaming, and this has undoubtedly played a large part in the improvements seen to date and there are moves afoot to try to replicate this success by imposing a regulatory speed limit. However if speed were the only factor, one might expect a sharper drop in our gCO2 per tonne mile KPI followed by a plateau, unless the speed reduction was gradually applied. What other changes in the fleet would result in a gradual drop?

There have certainly been investment in energy saving measures too – paint, hydrodynamic devices, hull optimisation, improved engine efficiencies, propeller optimisation, hull cleaning and so on, though it should be noted that shipping companies have found it challenging to quantify the benefits, even with big data.

An often overlooked factor is ship size. Clarksons Research helpfully produced some analysis recently showing that average ship sizes had increased over the last 20 years; in the case of gas carriers and container ships the average size had doubled in that time and were still growing. Bulk carriers were 50% larger, and only tankers were fairly constant, as one might expect. The Panama canal widening has also opened up possibilities for larger panamax ships with increased beam and reduced ballast designs.

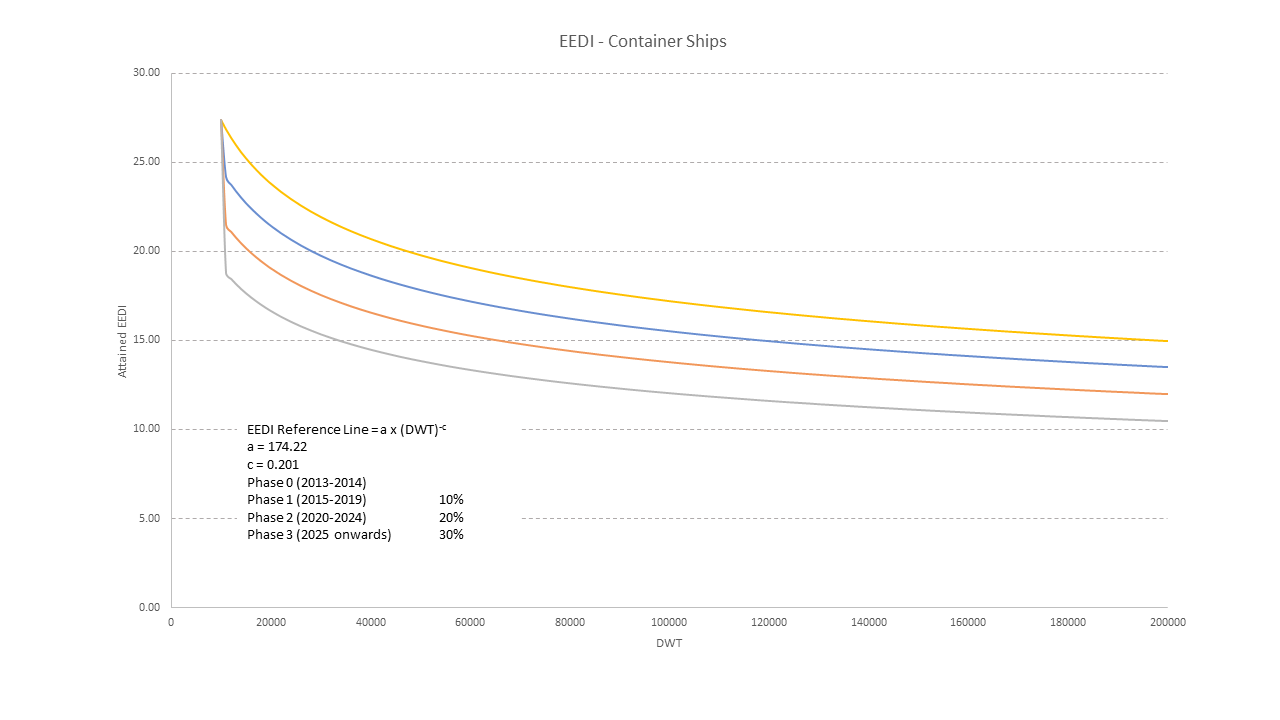

How does increasing ship size correlate with reduced CO2? Look at any EEDI curve and you will notice that CO2 per tonne mile naturally decreases with increasing ship size, a function of efficiencies of scale.

You also get a sense of how these efficiencies of scale work when you consider the average carbon intensity of freight modes - going from vans with single digit payloads, to trucks in the double digits and upwards to ships in the four to six digit range of deadweight.

Source: Professor Alan McKinnon

In terms of a driver for these changes, fuel price tends to be the obvious candidate - this was also my view until I started putting these numbers together.

Source: Bunker price (IFO 380 FOB Singapore) on the right axis, CO2 on the left. Bunker price from Bunker World via Ministry of Transport New Zealand

There doesn't appear to be much correlation between bunker price and CO2, though it should be noted that there is some difference in frequency - bunker price is shown quarterly and CO2 is yearly. A longer time series may also show some improved correlation. The large fluctuations in bunker price and the associated impact seems to make the effectiveness of any form of fuel levy somewhat difficult to predict and may indicate that the value of the levy would need to be larger than the likely fluctuation of the bunker price itself. It has been suggested that the market (in terms of charter rates) has a much stronger correlation and a cursory glance at the BDI or any of the container indices seem to bear this out.

Source: Kitco

At the very least, proposals for a fuel levy or other carbon pricing would need to be carefully evaluated to ensure that the desired outcome of CO2 reduction is actually achieved.

Coming back to the basic question in part 1, the world shipping fleet appears to be more efficient in 2015 than at any time between 2005 and 2015, with nearly all the 30% improvement occurring post 2009. The main driver for this does not appear to be regulations or high bunker prices, but the poor market conditions from 2009 onwards, although bunker prices may well have compounded the effect of the poor market. While slower operating speeds are most likely the major contributor to these improvements, the increase in the average size of ships is also likely to have played a part, along with awareness and investment into energy efficiency measures.

In general, the term efficiency in this article is used somewhat loosely to mean the energy efficiency of transporting freight. Efficiency improvements are really aimed at reducing the amount of energy used per tonne mile, but there are limits to what can be achieved. As can be seen above, efficiency improvements are tailing off, and struggling to keep pace with the rate of world fleet growth which is in part a response to the growth in world trade. While industry stakeholders are working on ways to achieve further efficiency improvements, significant reduction in CO2 emissions can only be achieved with a shift to a non-carbon based marine fuel or energy storage medium.